How do I get PRIME?

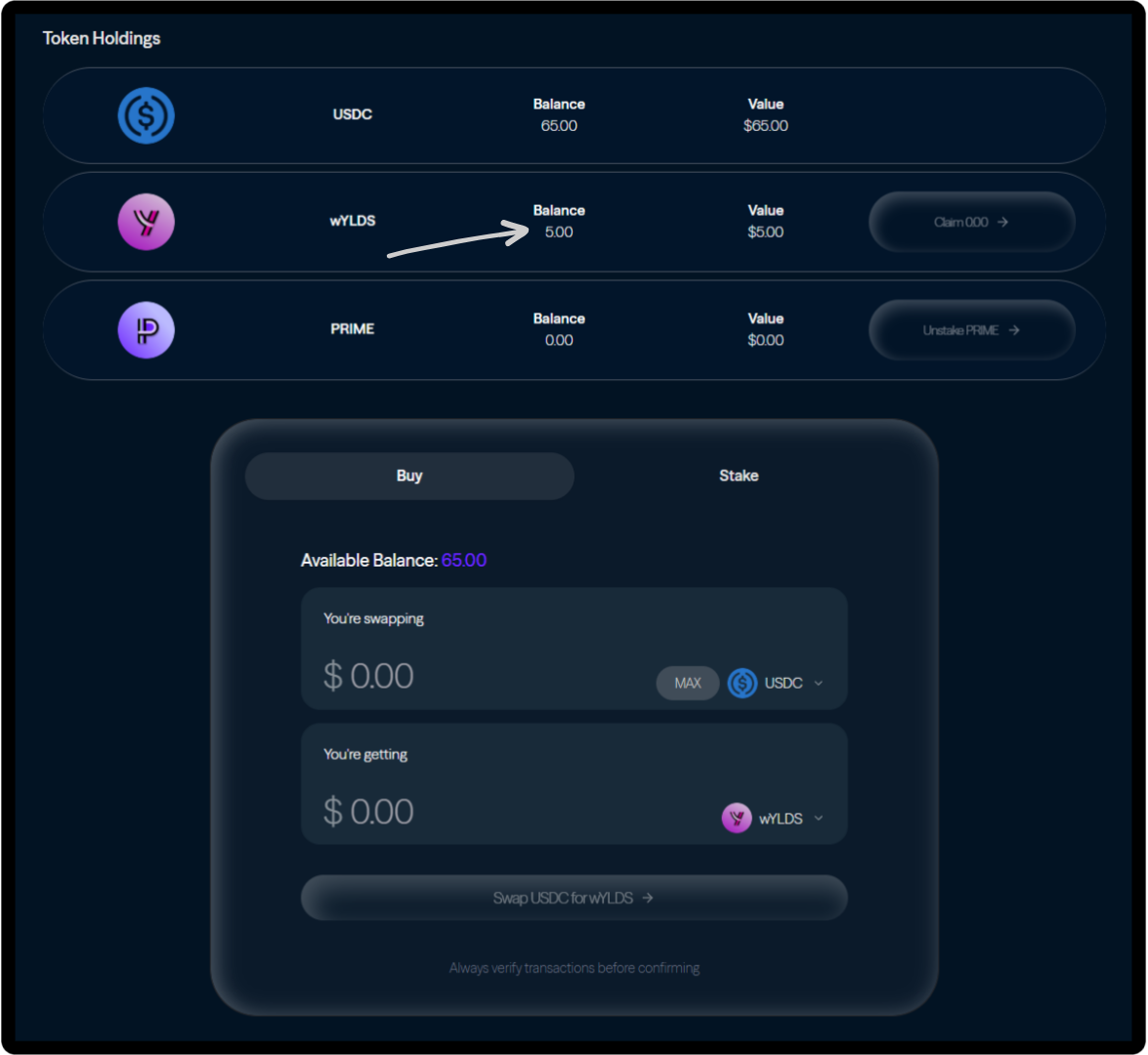

- Get wYLDS first: You need wYLDS to stake for PRIME

- Visit Hastra's Dashboard: Connect your wallet

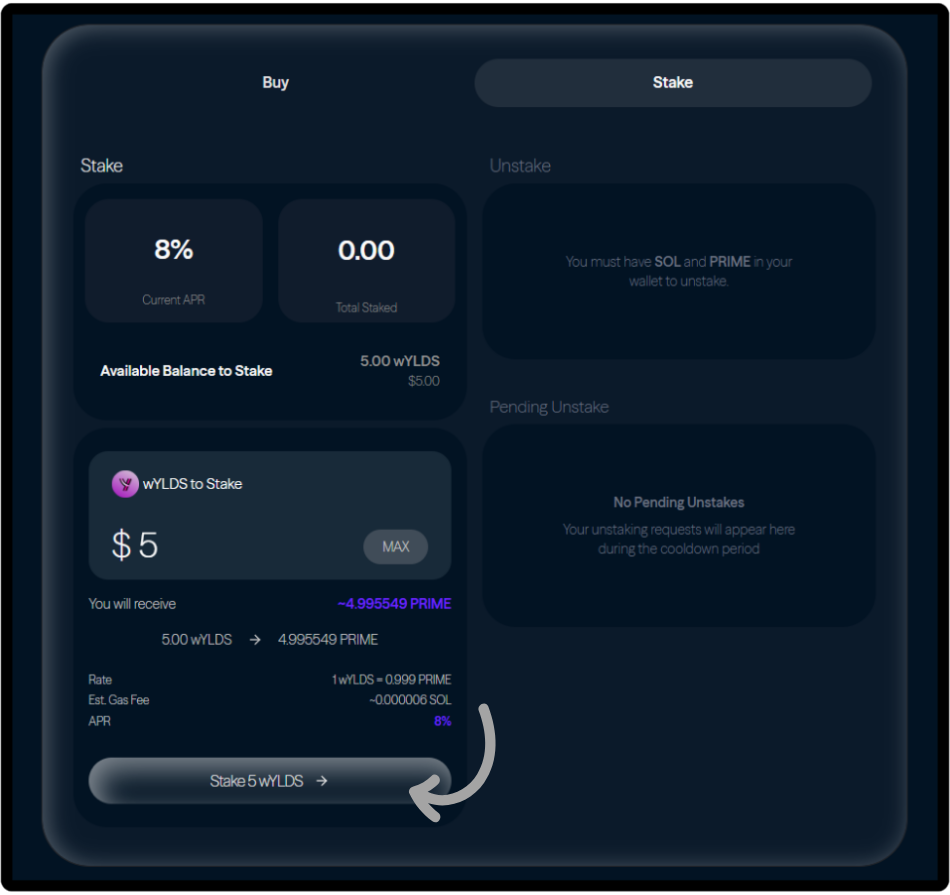

- Head over to the Stake tab: Deposit your wYLDS to receive PRIME

- Start earning: Begin earning higher yield from Demo Prime operations

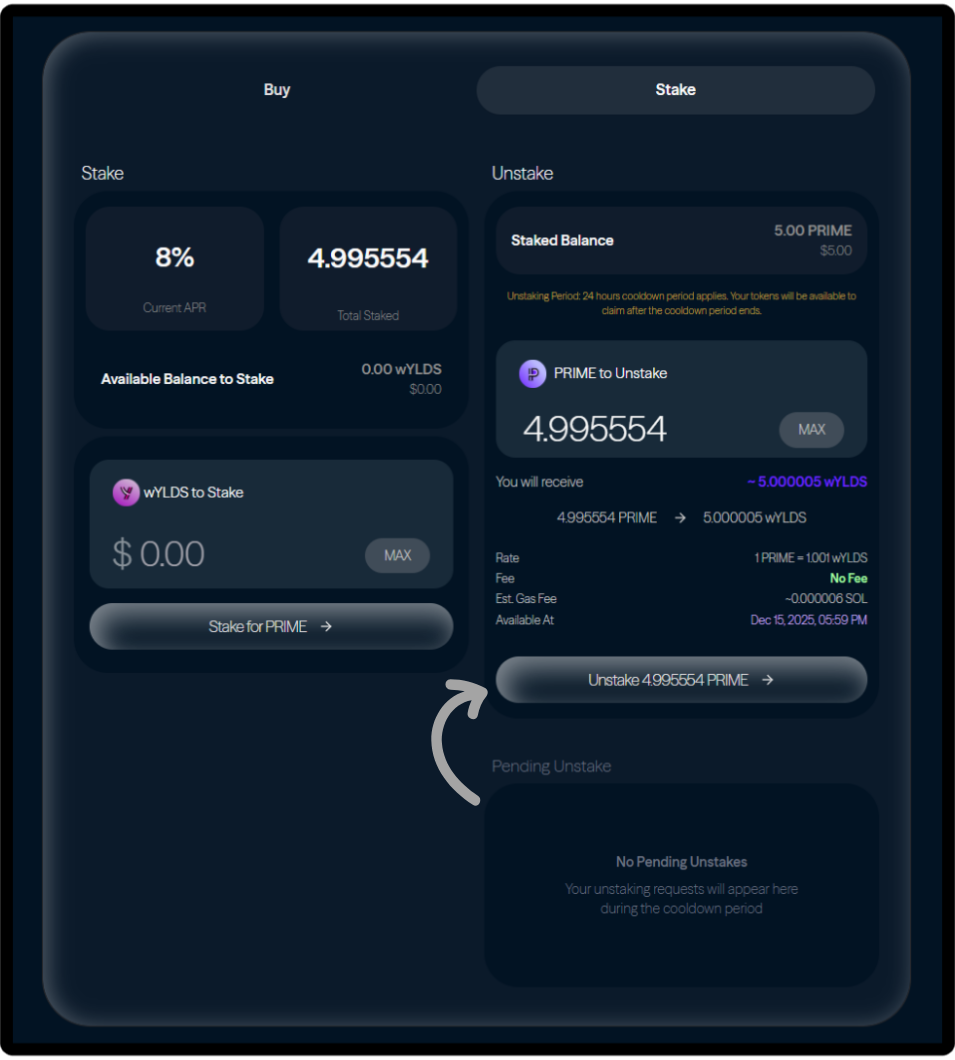

- Unstake anytime: You aren’t locked in forever, you’re able to unstake your funds at any given time

What can I do with PRIME?

Earn Passive Income

- Hold PRIME to earn higher annual yield

- Yield comes from real HELOC lending operations

- No rebasing - your token count stays stable

Use as DeFi Collateral

- Supply to lending protocols on Solana

- Continue earning yield while borrowing against it

- Create leverage strategies for enhanced returns

Leverage Looping

- Use it to create leveraged positions

- Target yields can vary up to 12% at 47% LTV

- Multiply your exposure to real-world asset yields

Where does the yield come from?

The PRIME yield originates from real-world lending operations:

- Demo Prime (DP): Lends to real estate borrowers using HELOC products

- Real Assets: Backed by actual home equity lines of credit

- Regulated Process: Operating within established financial frameworks

- Sustainable Yield: Based on actual lending spreads, not speculative trading

What are the risks?

Smart Contract Risk

- Depends on Hastra's smart contract security

- Bridge and staking contract functionality

Market Risk

- PRIME value can fluctuate relative to other assets

- Impact on DeFi positions using PRIME as collateral

Counterparty Risk

- Reliance on Demo Prime's lending operations

- Hastra's management of the ecosystem

Regulatory Risk

- Changes in regulations affecting the ecosystem

- Impact on cross-chain operations

How is this different from other yield tokens?

Feature | PRIME | Traditional DeFi Yield | Rebasing Tokens |

Yield Source | Real-world HELOC lending | Trading fees, liquidity mining | Token supply inflation |

Stability | Stable token count | Variable, often unsustainable | Balance changes daily |

Regulation | Built on SEC-registered foundation | Usually unregulated | Usually unregulated |

Sustainability | Based on lending spreads | Often temporary incentives | Mathematical, but complex |

Frequently Asked Questions

Can I transfer PRIME to other wallets?

What happens if I lose access to my wallet?

How often are yields distributed?

Can I use PRIME on other blockchains?

Is there a minimum staking amount?

This article is for educational purposes only and does not constitute financial advice. Always do your own research and consider consulting with financial professionals before making investment decisions.